|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

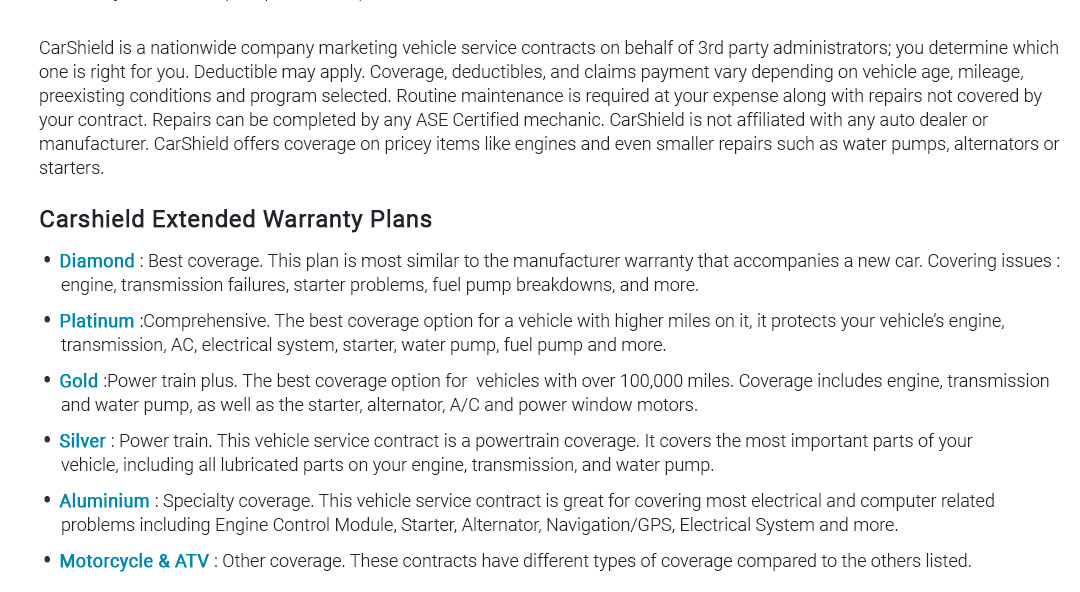

Understanding Roadside Insurance: A Quick Dive into Its EssentialsWhen we think about the myriad responsibilities of owning a vehicle, one aspect that often stands out is the necessity of roadside insurance. This unique form of insurance, often underrated, can be a savior in the most unexpected moments. Imagine cruising down a serene country road, the wind in your hair, and suddenly, your car comes to an inexplicable halt. It's scenarios like these where roadside insurance steps in, bridging the gap between helplessness and immediate assistance. Essentially, roadside insurance is designed to provide emergency support for vehicle breakdowns. This can include a variety of services such as towing, battery jump-starts, flat tire changes, fuel delivery, and even lockout services. It's a comforting safety net, ensuring that you're never stranded for long. Interestingly, many drivers overlook this service, underestimating its value until they're faced with a sticky situation.

While some might argue that the cost of roadside insurance could be an unnecessary expense, particularly if they rarely travel long distances, it's worth considering the peace of mind it affords. The cost is typically minimal, especially when bundled with comprehensive auto insurance, and the benefits can far outweigh this modest investment. Furthermore, some credit cards offer complimentary roadside assistance as part of their perks, a little-known fact that could save savvy consumers money. On a more personal note, having roadside insurance can transform the driving experience. It shifts the focus from worry and potential inconvenience to pure enjoyment and freedom. There's a certain liberation in knowing that whatever happens, help is just a phone call away. In today's fast-paced world, where time is of the essence, having a reliable plan in place for unexpected vehicular issues is not just practical but almost essential. In conclusion, while roadside insurance might seem like an optional add-on for some, its true value becomes apparent in moments of need. Whether you're a daily commuter or an occasional road trip enthusiast, investing in roadside insurance can be a smart move, providing a layer of security and reassurance that enhances the overall driving experience. So next time you're reviewing your insurance options, consider adding roadside insurance to your plan; it might just be the best decision you make for your car and your peace of mind. https://www.mofbinsurance.com/OtherServices/EmergencyRoadsideAssistance

Missouri Farm Bureau offers emergency roadside assistance for many different services that you might need. https://www.amfam.com/insurance/car/coverages/emergency-roadside-service

24/7 Emergency Roadside Service coverage helps you pay for service and support if your car breaks down and you need help getting to a mechanic. https://www.libertymutual.com/vehicle/auto-insurance/coverage/roadside-assistance

Distressed woman calling her insurance company after a car accident. How to add 24-Hour Roadside Assistance to your policy. To access ...

|